Understand what FinCEN’s Beneficial Ownership Information Reporting Requirements are and

what the penalties for non-compliance are. Learn how the Corporate Transparency Act aims to

combat financial crimes through corporate transparency. Discover what types of businesses need

to submit reports, what types of businesses are exempt from submitting reports, and when the

BOI reports are due.

Understand the Beneficial Ownership Information Reporting Rule (BOI). Starting January 1,

2024, businesses face a new federal regulation from the Corporate Transparency Act. Our article

delves into the purpose of the BOI reporting requirement, its impact on small businesses, who it

applies to, and how to file your BOI report. Discover if your business is a “reporting company”

and explore exemptions. Combat financial crimes like money laundering and fraud by disclosing

beneficial ownership details to the government. Stay informed to avoid fines of up to $10,000

and criminal charges.

A limited liability company (LLC) is a popular business structure among small business owners for its liability protection, management flexibility, and specific tax advantages this form of business entity can provide. Understanding the benefits and limitations of an LLC, how to create an LLC, where to form your LLC, and other important topics are essential..

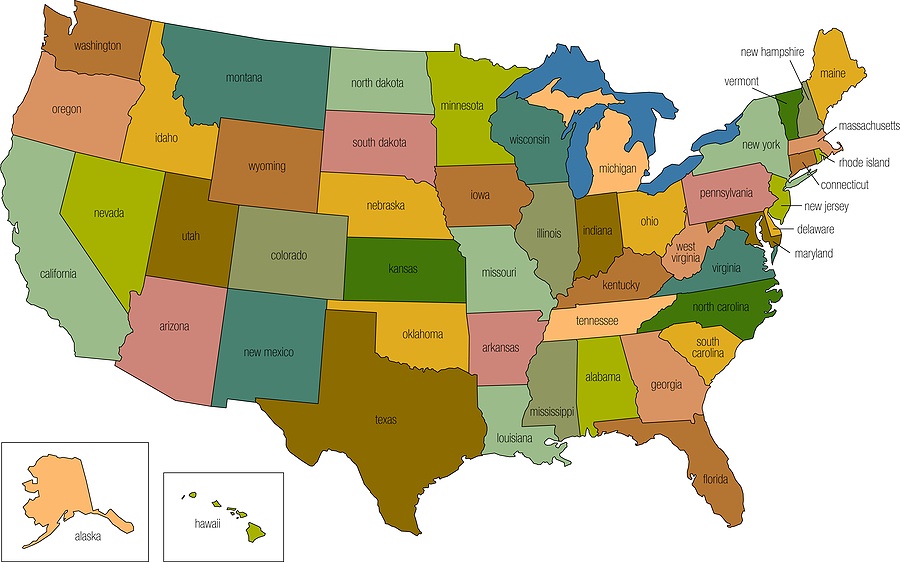

Navigating the Intricacies of Expanding Your Business Across State Borders Expanding your business beyond the state in which it was originally registered is a promising venture, but it entails navigating a complex regulatory landscape known as foreign qualification. Foreign qualification, a process often shrouded in misconceptions and jargon, is the formal registration of your business..

Circumstances can arise that lead an entrepreneur to look into how to file for an LLC business name change. However, before jumping straight into that option, other alternatives exist such as applying for a DBA or “Doing Business As.” This provides a similar result but operates under a different set of legal rules. What makes..

It’s quite natural, and in some cases, very good news, for a company to need a business conversion. One of the most common reasons is that a business is doing well, growing, and has become too big to qualify in its current class and must move to another. Entrepreneurs may want to know how to..

For budding entrepreneurs considering starting a business, there’s a lot more to it than just putting a sign on a door that says “open” or creating a website where you can start taking orders. Going into business involves getting it legally recognized at the local, state, and sometimes even federal levels. It means having public..

When a business is dissolved, it is formally and legally closing its operations. This involves more than just deciding not to run the business and keeping the doors closed. This process includes: Filing Dissolution Paperwork A legal process is required so local and state records can recognize and mark a business as closed. This is..

A limited liability company, or LLC, is the same no matter the state. Once an LLC has been registered, the way it operates and handles taxes follows similar general guidelines. However, the exact way an LLC operates, and the details of its financing, differ from one state to the next. This means that details like..

A business may be dissolved for several reasons. These reasons may include falling out of compliance with state regulations, or even personal circumstances such as illness or retirement. But even after a business has been dissolved by the state, there are some circumstances that make it possible to return through “Business Reinstatement.” One crucial role..