One of the first things a company needs to do is to choose a business structure. A popular choice among new entrepreneurs is the limited liability company (LLC).

About LLCs

Choosing the right business entity structure is important. It can determine the way the company will be managed, its obligations, and how it will be taxed.

Before learning how to set up an LLC, it is important to understand what it is first. The LLC became popular because of the asset protection and flexibility that it offers. The management of an LLC is also simpler compared to a corporation. There is no need to conduct annual shareholders’ meetings and keep well-detailed minutes of meetings.

Additionally, there is no restriction when it comes to the number of members. It can have a sole owner and be a single-member LLC. Having more than one member will make it a multi-member LLC.

Benefits of Forming a Single-Member LLC

Being the sole owner of a company can be exciting. It also provides more freedom because there will only be one decision-maker. But is a single-member LLC a good option? Here are some of the benefits an entrepreneur can get:

- Personal Asset Protection – As stated earlier, an LLC offers asset protection. Similar to a corporation, an LLC will have limited personal liability. The owners, who are called members, will not be personally liable for the actions and debts of the company. That means someone who sues the company cannot make a legal claim on the member’s personal assets.

- Credibility – Having the term “Limited Liability Company” or an abbreviation like “LLC” or “L.L.C.” can help build the credibility of a company. Suppliers are more likely to work with a business entity if they know that it is properly registered with the state. Consumers may also be more comfortable transacting with a registered business because it assures them that the company’s operations are legal.

- Flexibility In Taxation – By default, a single-member LLC is taxed as a sole proprietorship. That means the company will not file income taxes at a corporate level. Instead, the owner will report business income on their personal tax returns. In some cases, a single-member LLC may also opt to be taxed like a corporation.

- Growth – A startup can begin as a single-member LLC and start accepting new members once it deems them necessary. That may be done for expansion. In such cases, the single-member LLC will turn into a multi-member LLC. Expanding operations in other states using the same LLC name is also possible through foreign qualification.

Best State to Set Up a Single-Member LLC

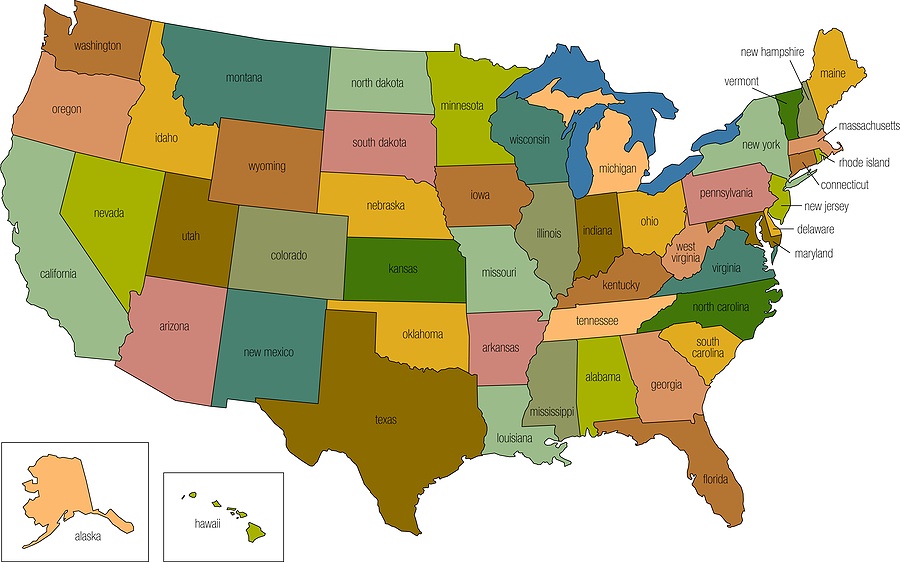

The process of how to set up an LLC will vary. That is because the requirements, steps, and fees depend on state laws. So it is necessary to understand the business formation process in the state where the company plans on organizing an LLC.

Generally, an entrepreneur can form a single-member LLC in any state. This can be where they live or where they do business. Before choosing a state, it is best to weigh all of your options first. Doing this will help you find the best place to set up a single-member LLC.

As stated earlier, a single-member LLC is a disregarded entity when it comes to taxation. With that in mind, the best state to start may be the place of residency of the member because it is where they are already paying state taxes. In most cases, organizing an LLC in another state may not help in saving money on income taxes. That is because all business profits and losses will eventually flow through to the owner’s personal tax return.

Some entrepreneurs also consider the difference in state corporate laws. For instance, many choose Wyoming because it ranks 1st in corporate tax rate and individual income taxes. However, it may not always be the best option. Consider the operations of the business. If the company will operate in the member’s home state, it may not be practical to organize it elsewhere. That is because the LLC needs to register in all the states where it operates.

In choosing where to form a single-member LLC, it is crucial to consider taxation and state corporate laws. However, the most common will be the place where the company will conduct its business operations. For example, if a company will transact business in Nevada, that may be the safest option.

To learn more about how to set up an LLC, consult seasoned professionals. Contact DoMyLLC today to talk to one of our experts.